Navigating the Enrollment Process for Medicare Benefit Insurance Coverage

As individuals approach the stage of thinking about Medicare Benefit insurance policy, they are satisfied with a labyrinth of choices and policies that can sometimes really feel overwhelming. Allow's check out just how to efficiently browse the enrollment procedure for Medicare Benefit insurance.

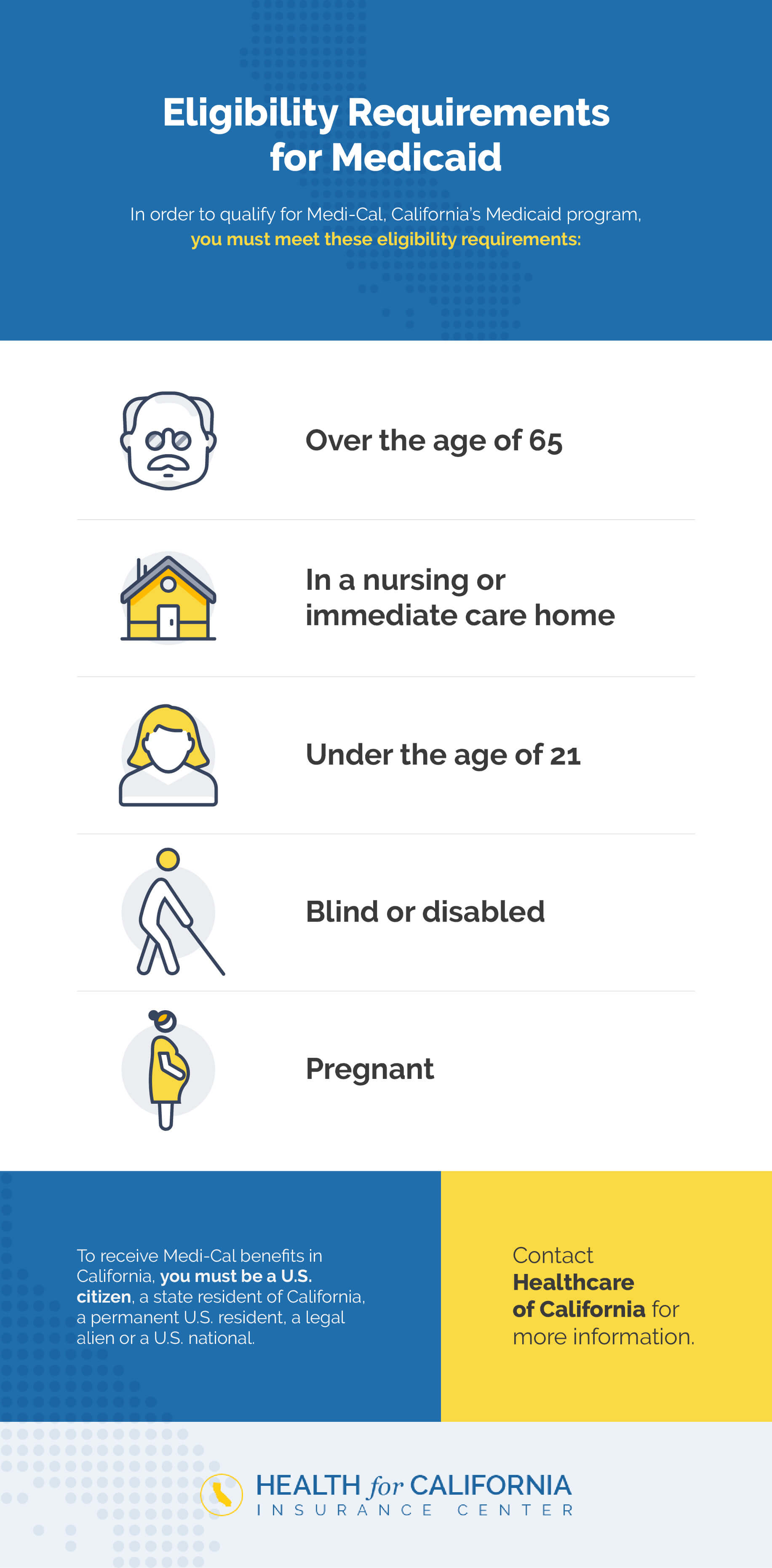

Qualification Requirements

To get approved for Medicare Advantage insurance policy, individuals should meet details qualification requirements laid out by the Centers for Medicare & Medicaid Provider (CMS) Qualification is largely based upon aspects such as age, residency status, and enrollment in Medicare Component A and Part B. A lot of people aged 65 and older get Medicare Advantage, although particular individuals under 65 with qualifying impairments may likewise be qualified. Furthermore, people need to stay within the service location of the Medicare Advantage strategy they desire to sign up in.

Furthermore, people should be signed up in both Medicare Part A and Component B to be qualified for Medicare Advantage. Medicare advantage plans near me. Medicare Advantage strategies are needed to cover all services provided by Initial Medicare (Part A and Part B), so enrollment in both components is necessary for individuals seeking coverage with a Medicare Advantage plan

Protection Options

Having actually satisfied the qualification requirements for Medicare Benefit insurance coverage, people can currently explore the different insurance coverage alternatives readily available to them within the strategy. Medicare Benefit intends, additionally referred to as Medicare Component C, use an "all-in-one" alternative to Original Medicare (Part A and Component B) by offering fringe benefits such as prescription medicine insurance coverage (Component D), vision, dental, hearing, and wellness programs.

One of the primary protection choices to think about within Medicare Advantage plans is Health and wellness Maintenance Company (HMO) plans, which typically require individuals to select a main care physician and acquire recommendations to see professionals. Unique Demands Strategies (SNPs) provide to individuals with particular health problems or those who are dually qualified for Medicare and Medicaid.

Recognizing these protection options is crucial for people to make informed decisions based on their health care requirements and choices.

Registration Periods

Steps for Registration

Comprehending the registration periods for Medicare Advantage insurance policy is crucial for beneficiaries to browse the process successfully and effectively, which starts with taking the needed actions for enrollment. The very first step is to determine your qualification for Medicare Advantage. You must be registered in Medicare Part A and Component B to receive a Medicare Benefit plan. When qualification is validated, study and compare readily available strategies in your location. Consider factors such as costs, deductibles, copayments, insurance coverage options, and provider networks to pick a strategy that finest matches your health care requires.

You can sign up directly via the insurance coverage firm offering the plan, with Medicare's internet site, or by contacting Medicare straight. Be sure to have your Medicare card and personal details ready when enlisting.

Tips for Choice Making

When examining Medicare Benefit intends, it is necessary to thoroughly evaluate your specific health care demands and financial considerations to make an educated decision. To aid in this procedure, consider the complying with tips for choice making:

Compare Strategy Options: Research offered Medicare Advantage prepares about his in your location. Contrast their prices, protection benefits, provider networks, and quality scores to figure out which aligns best with your requirements.

Think About Out-of-Pocket Prices: Look past the month-to-month costs and think about aspects like deductibles, copayments, and coinsurance. Compute possible yearly expenses based on your healthcare usage to discover the most cost-effective option.

Evaluation Celebrity Ratings: Medicare appoints star rankings to Benefit prepares based on factors like customer satisfaction and top quality of treatment. Selecting a highly-rated plan may show much better general performance and service.

Conclusion

In verdict, understanding the eligibility demands, insurance coverage choices, registration periods, and actions for registering in Medicare Advantage insurance policy is vital for making notified choices. By browsing the registration procedure effectively and taking into consideration all offered information, people can guarantee they are selecting the finest strategy to fulfill their medical care needs. Making informed choices throughout the enrollment process can lead to much better health and wellness results and financial safety and security over time.